From time immemorial investing in jewels has been both a secure and safe investment option. Here we have compiled a straightforward how-to guide so you can choose your ‘one of a kind’ investment colored diamond jewelry.

Much like any investment purchase, risk vs. earning, is carefully looked at by experts in the field. Investors need to look at all sides of the proverbial coin to assess whether a diamond is high risk or has high ROI (rate of investment). For colored diamond investors, these are especially important factors, as the color adds to the rarity thus increasing potential earnings.

Following a specific grading system, namely the 4 C’s: clarity, cut, color, and carat, you can learn to choose a great investment with incredible reward potential.

Step-by-Step

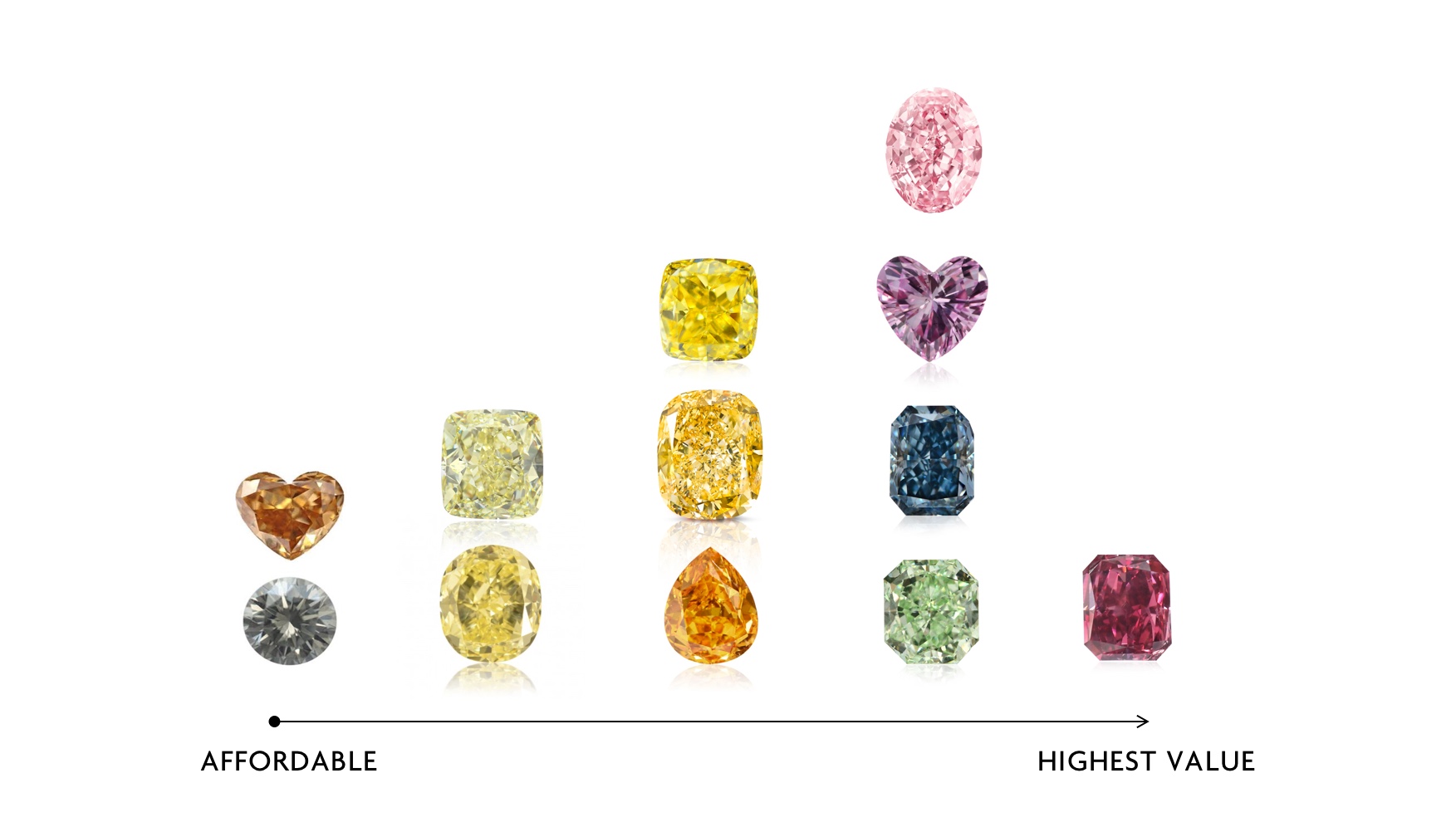

Know your budget. Colored diamonds can be bought as single gems or be split into different pieces, which will increase rarity and therefore value. Value is typically assessed by color grade, low to high:

- More Common Colors-Browns, Greys, Fancy Yellows

- Slightly Less Common-The Vivid and Intense Yellows, as well as combination pieces, for example, orange diamonds.

- Rare-Green, Purple, Pink, Blue and Oranges, all in their pure forms.

- Red Diamonds-a Class of their own

Please note, that this is a highly generalized breakdown that does not include factors such as carat or rare combinations. So, while a brown may be more common, a large carat with a unique combination can increase the investment potential considerably.

What do the experts look for?

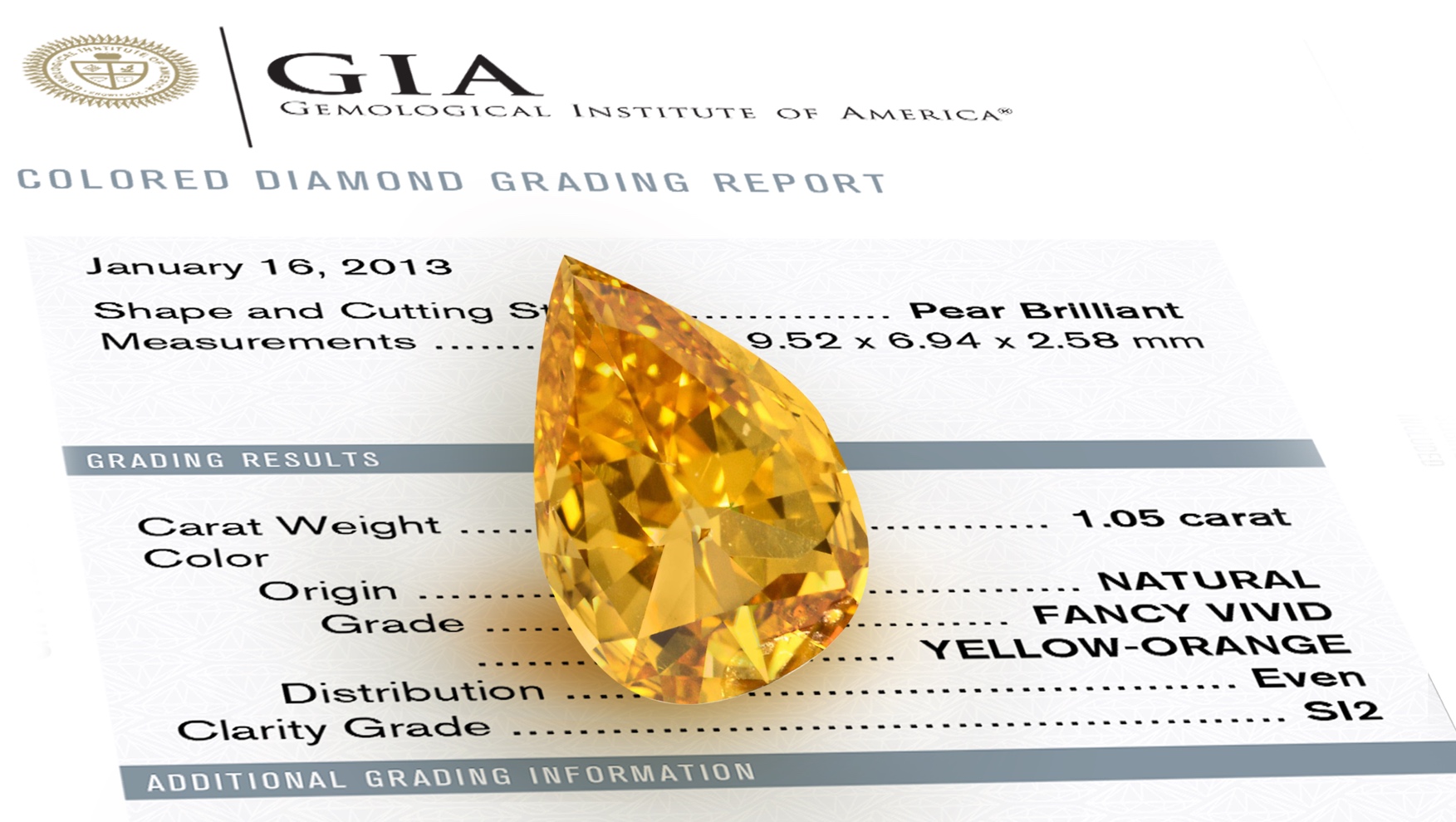

Of course, any search will begin with a review of certifications, by the GIA if possible, as it is accepted as the gold standard for diamond certification. Once this is established, the experts start to look for:

- Fluorescence - Caused by exposure to a UV lamp, purchasing these for investment is not acceptable and not worth the cheaper price. Fluorescence is only an issue with yellow diamonds.

- Clarity - Look for a VS2 and nothing lower than VS2 for lower range diamonds. Higher end diamonds should be at least eye clean, with a clarity grade of si1 or2.

- Cut, Shape and Carat - The quality of the cut will make or break your purchase. If the cut is on point, the diamond will have an exquisite brilliance while the opposite can make your diamond practically worthless.

For shapes keep it standard, round, cushion, princess, these are shapes people are looking to purchase. Round diamonds for a colored diamond are difficult and a good one will cost quite a bit as the size needs to be increased for the brilliance to be seen.Marquise, Oval, Radiant and Pear are good substitutes. Carat refers to the weight of the diamond. For investment purposes, price per carat will create high demand for sale. For the higher end colors like blues and pinks, the weight can be low and still snatch a great price. For more common colors look for one or more carats. - Color - The more vivid the color the better, because of rarity and quality. In the higher end colors fancy lights can be good investments but for the common range look for the most intense colors, you can.

Overall investing in diamonds is a challenging but potentially rewarding venture. By following expert advice, and these guidelines, you can improve your chances of choosing the right diamond jewelry for your collection.

The experts at Asteria Diamonds suggest you pay attention to trends and take your time whilst choosing a good investment.